Your company is getting requests from international buyers for open account credit terms. Don’t lose sales to foreign competitors because they have more flexible payment terms.

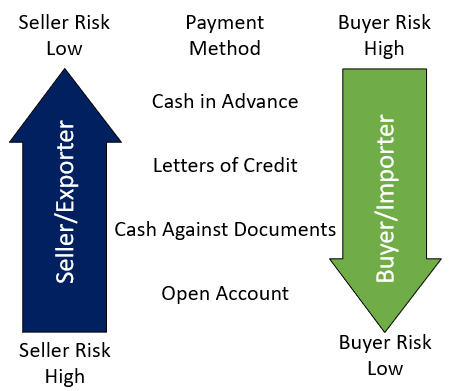

Getting paid is critical to every exporter’s success. When choosing a payment method your company needs to minimize risk while adjusting to the needs of the buyer.

Here are four payment methods for exporters to consider. Each method has its positives and negatives to consider.

Cash in Advance

Pro

This type of transaction ensures that the exporter has the least amount of risk because the payment is received before the foreign buyer receives the goods or services.

Cons

The foreign buyer’s cash flow is negatively affected, making this the least attractive payment option for the foreign buyer.

Since the foreign buyer is paying in advance of receiving the goods, there is a risk of non-delivery.

Exporters might lose sales to competitors who offer more attractive payment terms.

Letters of Credit

Pro

The strength of a lender commitment ensuring payment will be made when certain terms and conditions are met makes this a highly secure payment method.

Cons

Might be expensive since lenders charge fees to provide this service adding to the overall costs.

There is an expiration date which must be adhered to with a letter of credit. This time restraint can create additional costs and limits flexibility.

Each time there is a change to the letter of credit an amendment is required at an additional fee, creating even higher overall costs. These amendments may also delay the transaction creating additional cash flow issues.

This form of payment only assures delivery of the goods but does not account for any quality issues that may arise.

Cash Against Documents

Pros

A lender acts as the U.S. company’s agent in collecting documents.

Less costly than a letter of credit.

Cons

The foreign buyer can refuse delivery without payment.

Any discrepancies in documentation can cause delays.

Open Account Credit Terms

Pros

A U.S. supplier becomes much more attractive to foreign buyers when they provide open account credit terms.

Open account credit terms can be used as a sales tool to beat the competition and win the deal.

This is a less expensive and more streamlined method for both the exporter and foreign buyer.

Buyers tend to buy more when they have the option of credit.

Con

The foreign buyer may not pay.

Get the best of both worlds

How does your company get the security of cash in advance with the competitive advantage of open account credit terms? Export Credit Insurance

When your company offers open account credit terms and insures those foreign receivables with the Export- Import Bank of the United States (EXIM), your company can receive payment if the foreign buyer doesn’t pay.

If your company is currently exporting or just thinking about it, EXIM has products and services designed to minimize the risk of foreign buyer nonpayment and boost your company’s international sales! Free consultations are available to learn how EXIM can expedite the process.