To better serve small business owners, companies have started to create simple digital tools and systems that allow small businesses to run faster and more efficiently. These affordable solutions can be anywhere from cash flow management solutions to e-Invoicing. In the past, small business owners have used traditional methods of running their business because they have few resources and personnel on hand. In addition, the time to research and discover these new tools is very hard to do for a small business owner.

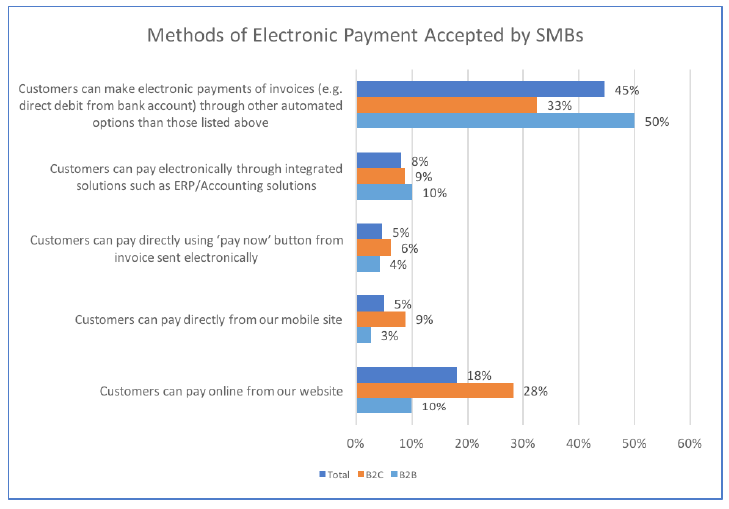

According to the most recent PYMNTS.com SMB Technology Adoption report, just 13 percent of small to medium-sized businesses (SMB) are willing to jump on the innovation bandwagon. About 80% of smaller business to consumer (B2C) merchants still cannot accept mobile wallets like Apple Pay or Android Pay. This poses a problem because if small business owners are not keeping up with innovative payment solutions, it will hurt them in the long run as consumers start to expect these types of payment solutions. In addition, 97 percent of business to business (B2B) merchants rely on paper checks and most importantly, their biggest concern is getting paid on time. SMBs usually struggle with cash flow issues because they can’t tap into reserves like larger corporations, however, adoption of invoicing products can be the difference maker and allow businesses to continue running in the black. Here’s an illustration on methods of electronic payments accepted by SMBs:

From PYMNTS’s SMB 2016 Technology Adoption Index Report:

EXIM Support

At EXIM we understand small business owner pain points such as cash flow or liquidity issues. According to the 2016 Small Business Exporting Survey, 44 percent of exporting respondents cite “worrying about getting paid” as their biggest challenge. As a federal agency, we help small business owners cover the risk of nonpayment in case a foreign buyer does not pay, thus allowing small business to continue running their engines. In addition, we have a working capital guarantee product that can help increase small business exporters' borrowing capacity because it enables banks to lend against a larger percentage of a company’s accounts receivables and collateral that lenders typically don’t cover. This frees up cash to help fulfill those export orders.

For more information on our trade financing solutions, click below to speak to your local EXIM rep: