EXIM’s Short-Term Single-Buyer Export Credit Insurance (ECI) enables qualified U.S. exporters to insure against not getting paid for one or multiple shipments to a single international buyer. The amount of insurance for sales to a private sector international buyer is 90% of the invoice value. The policy protects against losses due to commercial reasons (such as insolvency, bankruptcy, and slow pay) as well as political events (such as seizure of goods and currency transfer risk). All invoice insurance policies enable eligible U.S. exporters to offer more competitive open account terms to international buyers rather than asking these customers to pay cash-in-advance or by other less favorable payment terms.

For qualified U.S. exporters, there’s a lot of upside to Single-Buyer policies from a cost perspective, too – the policies never have a deductible, there’s no minimum transaction size requirement, and most policies only have a $500 policy issuance fee (refundable if the premium paid during the first year exceeds the fee) if the exporter is a small business as defined by the U.S. Small Business Administration. Insured exporters only pay policy premiums based on what they ship to their insured international buyer.

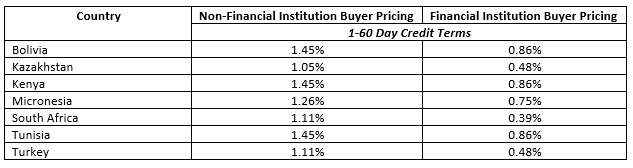

Single-Buyer invoice insurance policy premiums depend upon the country of the buyer, whether the buyer is from the private or public sector, and the length of invoice terms (e.g., 1-60 days). While actual fees will be confirmed upon the approval of a completed application, EXIM’s nonbinding fee calculator displays 175+ countries around the world where EXIM is available and provides premium estimates based on these countries. A few examples are provided below (rates shown are based on time of this publication):

U.S. exporters should review the Pre-Application Checklist and the complete terms and conditions in the insurance policy before applying.

Whether you have one or several international buyers lined up, EXIM registered brokers are located around the country to assist U.S. exporters. An EXIM trade finance specialist can pre-qualify your company to work with EXIM then connect you with an EXIM Registered Insurance broker who services your area. Click here to schedule a free consultation request with an EXIM trade finance specialist.