Trying to ascertain the cost of export credit insurance can involve some legwork because of the variables involved, namely the country where the goods are being exported to, the invoice payment terms, and the invoice amount. For this reason, EXIM created a Fee Calculator to provide U.S. exporters with a rough estimate of policy costs.

There are several calculators listed on the EXIM.gov website; select the Short-Term ELC and ESS version to get started. ESS is EXIM’s abbreviation for short-term single buyer policies and ELC signifies short-term letter of credit policies. The other calculators available are short-term FIBC, medium-term indicative fee, and long-term exposure fee and they apply to different products that are less applicable to small businesses.

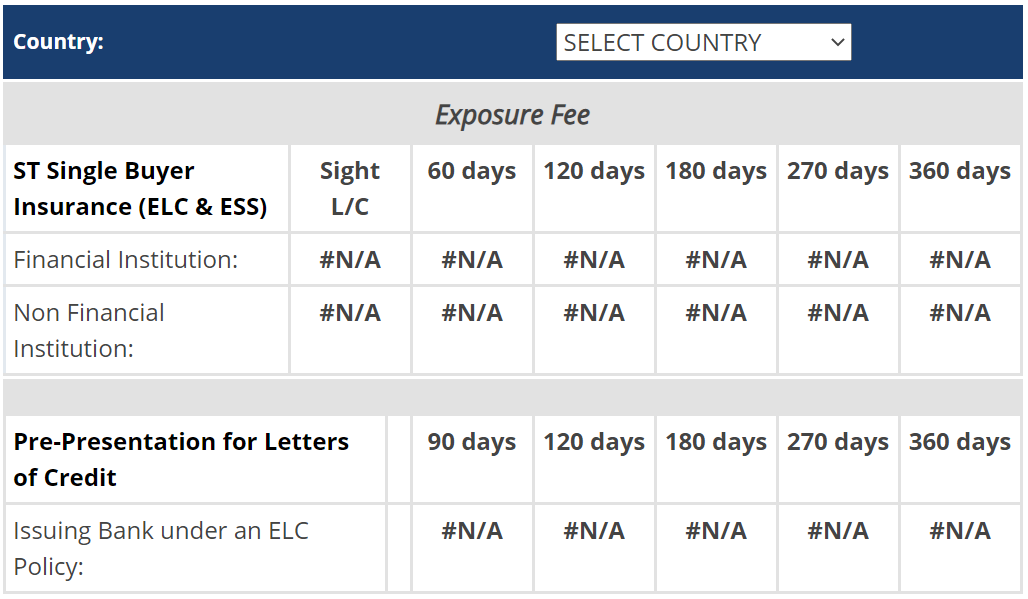

EXIM’s Short-Term ELC and ESS Fee Calculator

As shown in the tables above, there are two sections within the Short-Term ELC and ESS calculator - Short-Term Single Buyer Insurance (ELC & ESS) and Pre-Presentation for Letters of Credit. The former section has two categories – Financial Institution and Non-Financial Institution while the latter just has one. Look to the Non-Financial Institution row for export credit insurance transactions involving an international private buyer as the Financial Institution row is for insuring letters of credit under a short-term policy (the letter of credit is issued by the foreign buyer’s financial institution and provided to the U.S. exporter.)

The Pre-Presentation for Letters of Credit section is for U.S. banks to use when determining the cost to obtain a pre-presentation agreement under which EXIM agrees not to withdraw insurance coverage.

Next, choose the destination country where you plan to invoice from the alphabetical ‘Select Country’ dropdown menu, then each row will populate with rates. Scan the Non-Financial Institution row, then the applicable terms column, and multiply the rate shown by your invoice amount. You now have an estimate for a single buyer policy. Please note that the calculator doesn’t cover multi-buyer policies, however they are typically less than the single-buyer rates shown. Actual fees will be confirmed upon approval of a completed application, and an EXIM trade finance specialist will be glad to assist you anytime along the way.