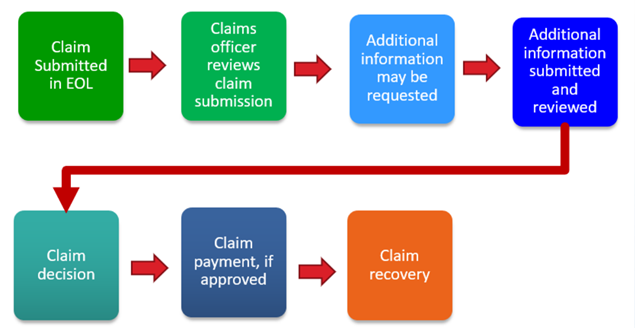

EXIM’s Claims Processing Division processes claim filings in accordance with EXIM’s policies and procedures and to ensure payment of claims in a timely manner. The division handles claims for all EXIM products including Export Credit Insurance and Working Capital Loan Guarantees. Should a policyholder ever need to file an insurance claim, the process looks like this (EOL is abbreviated for EXIM Online, a transaction management system which supports various insurance and loan guarantee products):

Source: EXIM's Claims Processing Division

While uncommon, claim denials can occur for a variety of reasons. The division cited several of them, including inadequate shipping documents, inconsistent buyer names on the face of the buyer obligation documents (the invoice, bill of lading, and international purchase order or sales contract), and failure to file a claim on time.

An example of inadequate shipping documents is an insured exporter submitting a bill of lading to EXIM’s Claims Processing Division that the company drew up internally rather than providing one that was issued to the exporter by an unaffiliated third party, such as an ocean carrier. The bill of lading contains details such as the pickup dates of the goods, their origin and destination, and the carrier's signature, and it provides verification to EXIM that products were exported, which is why it must be generated by a third party.

Next, insured exporters should confirm the buyer’s name and address in their home country is consistent throughout when submitting buyer obligation documents to EXIM in the event of a claim. The buyer obligation documents show that a transaction was legitimate, so a different buyer listed on any of these documents could potentially cause issues.

Lastly, short-term insurance claims must be filed after payment to the exporter is 90 days past due and before 240 days of the invoice being past due, however other EXIM products have different claim filing deadlines. Additionally, if an insured exporter has knowledge that its international buyer entered bankruptcy or receivership, the insured has 30 days to file a claim. A claim filing extension can be requested by contacting claims@exim.gov.

In addition to these examples, there are other claims mistakes to avoid for Single-Buyer and Multi-Buyer Insurance. For more information about EXIM’s products and policies, please click here to schedule a consultation with an EXIM trade finance specialist.