The Export-Import Bank of the United States (EXIM) recently partnered with the National Small Business Association (NSBA) to survey U.S. small businesses about their exporting practices, finding they are increasingly seeking international business opportunities in the wake of the global pandemic.

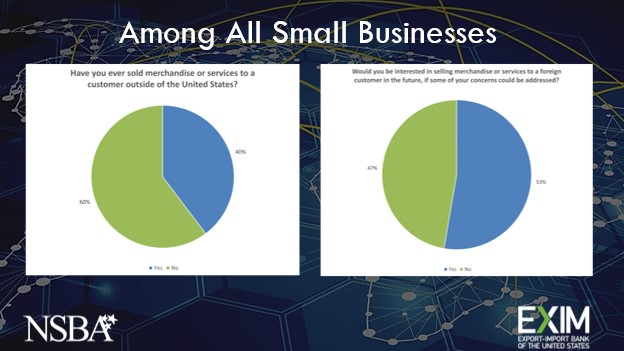

Among the small- and mid-sized exporters (SMEs) surveyed, 40 percent said they have sold goods or services to a customer outside the United States. Among those who haven’t, a majority of 53 percent said they would be interested in doing so.

“Hands-down the biggest challenge to those small businesses who are interested in exporting — but haven’t made the leap yet — is that they simply don’t know where to start,” said NSBA President and CEO Todd McCracken. “Expanding and strengthening the export assistance programs we currently have, like EXIM, could help small businesses more easily weather tough economic times.”

The 2022 Small Business Exporting Survey updates a previous one carried out in 2016 by EXIM and NSBA. The new version, conducted online among 530 small businesses across the country April 14-May 12, asked about their attitudes and beliefs toward exporting, and their practices while doing business internationally.

Exporting Can Boost a Company’s Growth

The survey highlighted a growing appetite for export-related assistance and education among U.S. small businesses, with the majority expressing interest in exporting, but believing they face significant hurdles.

“Having managed international sales at my company I can assure you that starting — and maintaining — international sales is a major undertaking,” said NSBA Chair Mike Stanek of Hunt Imaging, LLC in Berea, Ohio. “From finding foreign customers to navigating foreign import rules and, most importantly, making sure you get paid, exporting can be challenging but also very impactful to a company’s growth.”

The survey found these characteristics of U.S. small businesses:

- They are headquartered in all regions of the United States and its territories.

- The majority are established companies — 73 percent have been in business longer than five years.

- They represent a wide range of industries, and they are evenly split between providers of products and services.

- They are both exporters and non-exporters. Of the exporting companies, 60 percent are experienced sellers that have been exporting for more than five years.

EXIM Offers Financing Tools to Address Exporter Concerns

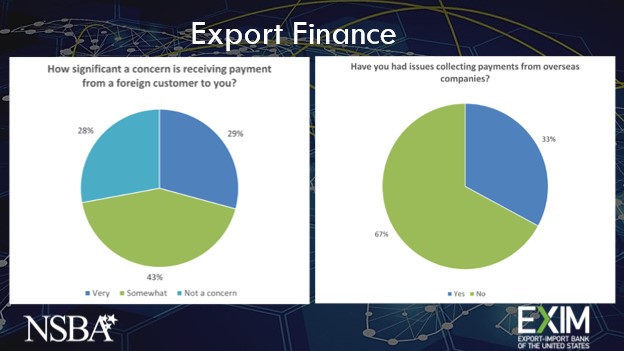

When it comes to export financing, the survey illustrated that small businesses need assistance to sell their goods and services in the global marketplace. Among the findings:

- 72 percent of those surveyed consider receiving payment from a foreign customer a “very” or “somewhat” significant concern.

- 33 percent have had issues collecting payments from international customers.

- 20 percent of those who are exporting said access to export financing was among the top challenges in sustaining or growing their export operations.

The survey results underscored that getting started with exporting is a unique risk for smaller businesses, but it also revealed that many are unaware of the government resources available to help them launch or expand their exporting business. EXIM offers Export Credit Insurance to mitigate the risk of nonpayment as well as Working Capital Loan Guarantees to unlock the cash flow needed to fulfill sales orders.

You can view a report of the survey’s findings here, with insights about exporting challenges and the resources to overcome them, including market research, government support, and tools for payments and financing. You also can hear NSBA President McCracken discuss the findings here.

To find out how EXIM can assist your business in starting or expanding your export journey , schedule a free consultation with a trade finance specialist today.